Institutionalization of Information Management into a Corporate Strategy, Pt. 3

Posted by Erhard Ludwig on May 1, 2009

I’m back from vacation and have some more time to continue my blog. Sorry for keeping you waiting!

In this post I will explain the method of the critical success factors and the portfolio analysis in more detail as the final part of the institutionalization so you hopefully have a better understanding of this complex topic.

Critical success factors

“Critical success factors (CSFs) are the limited number of areas in which satisfactory results will ensure successful competitive performance for the individual, department or organization.” (Rockar, Bullen 1981)

Let me give you some sources for CSFs so you get an idea what we’re talking about:

- Pattern of a branch (Strength and behaviour of customers and suppliers, …)

- Position within a branch (Image, geographical position, competitive position, …)

- Environmental influences (social, political, ecological, economical, …)

- Vision of the corporate management (ideals, business culture, …)

- Temporary influences (projects, exceptional events, …)

All these sources and many more can lead to competitive performance, but also determine the information need of the management.

Method of the inquiry of critical success factors

This method is a structured procedure to determine the information of the management, esp. of the top management.

Let’s assume there are three to six key factors, which determine business success. These factors have to be affected in a way so positive effects to the business success emerge.

The procedure consists of three steps:

- Discuss and determine CSF in meetings with (top) managers in terms of business success

- Determine indicators to measure the characteristics of the CSFs, the CSF-influencing activities and their impact on the achievement of objectives

- Measurement of the indicators and achieved real values for the target figure

The pros and cons

Pros

- Top-down approach based on goals and strategies

- Intensive user participation

- Explicit consideration of external information

- Integration of soft information or soft data along with business indicators

- CSF method is realizable with reasonable effort in a short space of time

Cons

- CSF method is not suited to determine the whole information need of the strategic planning

- Difficulties finding the really relevant CSFs and the indicators belonging to them

- Success of the method is heavily depending on the methodical, technical and firm-specific knowledge of the analyzers and interviewers

- Time-consuming and constructive co-operation of the (top) managers ist necessary

- Intuitive procedure, where subjectivity can get critical

Portfolio analysis

I think many of you are aware what a portfolio analysis is so I’ll just give you a brief description from businessdictionary.com:

“Analyzing elements of a firm’s product mix to determine the optimum allocation of its resources. Two most common measures used in a portfolio analysis are market growth rate and relative market share.” (businessdictionary.com)

As we focus on IT we have to the adapt the analysis: The goal of the analysis is to provide information on how the information infrastructure is like (is-portfolio) and how it should be like (goal-portfolio). With that information it is possible to maximize the achievement potential of the information function (see also first post of this topic). In other words: bringing together existing, planned and potential information systems and assessing their business contribution.

The procedure

There are two main steps containing substeps for the is-portfolio (step 1) and the goal-portfolio (step 2).

Step 1:

- Identify the competitors and their relative market shares

- Break down the information infrastructure in components and identify the competitive position of the components in the actual state

- Determine the competitive factors and their weighting and identify the resource strength of the components in the actual state

Step 2:

- Identify the theoretical possible resource strength of the components

- Identify the competitive position of the components in the goal state

Step 1.1

Consider max. seven competitors, set market shares up to 100%

| Competitor | Market share % |

| A | 35 |

| B | 25 |

| C | 15 |

| D | 15 |

| E | 10 |

Step 1.2

| Competitor | Market share % | Procurement | Production | Marketing | R & D | Accounting |

| A | 35 | 1 | 3 | 1 | 1 | 5 |

| B | 25 | 1 | 3 | 1 | 1 | 5 |

| C | 15 | 3 | 1 | 3 | 1 | 5 |

| D | 15 | 1 | 1 | 1 | 3 | 5 |

| E | 10 | 1 | 1 | 3 | 1 | 5 |

| C(Is) | 150 | 220 | 150 | 130 | 420 |

1 = Competitor has powerful components

3 = Competitor has equivalent components

5 = Competitor has weaker components

C(Is) = Value of the competive position

Step 1.3

| Competitive factor | Weight % | Procurement | Production | Marketing | R & D | Accounting |

| Technical advance | 15 | 1 | 1 | 0 | 3 | 0 |

| Price | 10 | 3 | 3 | 1 | 3 | 3 |

| Quality | 15 | 3 | 3 | 0 | 3 | 0 |

| Service | 25 | 1 | 1 | 1 | 1 | 0 |

| Dealer commitment | 5 | 0 | 0 | 3 | 0 | 3 |

| Brand loyalty | 5 | 0 | 1 | 3 | 1 | 1 |

| Close to the market program | 10 | 0 | 3 | 3 | 1 | 0 |

| Product design | 15 | 1 | 1 | 1 | 3 | 0 |

| R(Is) | 130 | 165 | 110 | 205 | 50 |

0 = Component has no influence on competitive factor

1 = Component has minor influence on competitive factor

3 = Component has medium influence on competitive factor

5 = Component has strong influence on competitive factor

R(Is) = Value of the resource strength

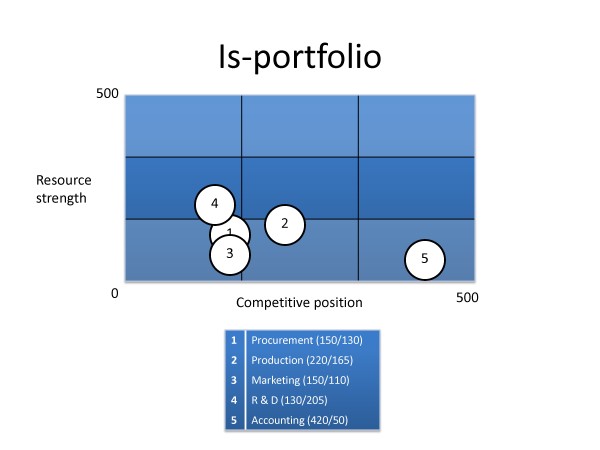

Here is the resulting is-portfolio (x-axis competitive position, y-axis own resource strength):

Step 2.1

The second step is to determine the portfolio for the goal state.

So step 2.1 is like step 1.3, with the only difference that the theoratically possible values of the resource strength of the components in the goal state are estimated.

| Competitive factor | Weight % | Procurement | Production | Marketing | R & D | Accounting |

| Technical advance | 15 | 3 | 3 | 0 | 5 | 0 |

| Price | 10 | 5 | 5 | 1 | 3 | 3 |

| Quality | 15 | 5 | 5 | 1 | 3 | 0 |

| Service | 25 | 3 | 3 | 1 | 3 | 1 |

| Dealer commitment | 5 | 1 | 1 | 5 | 0 | 3 |

| Brand loyalty | 5 | 0 | 1 | 5 | 1 | 3 |

| Close to the market program | 10 | 1 | 3 | 5 | 3 | 0 |

| Product design | 15 | 1 | 3 | 3 | 5 | 0 |

| R(Ideal) | 275 | 330 | 195 | 335 | 85 |

0 = Component has no influence on competitive factor

1 = Component has minor influence on competitive factor

3 = Component has medium influence on competitive factor

5 = Component has strong influence on competitive factor

R(Ideal) = Value of the resource strength

Step 2.2.

This step is like step 1.2, also with the only difference that we identify the competitive position of the components in the goal state.

| Competitor | Market share % | Procurement | Production | Marketing | R & D | Accounting |

| A | 35 | 3 | 5 | 5 | 5 | 3 |

| B | 25 | 3 | 5 | 5 | 5 | 3 |

| C | 15 | 3 | 3 | 3 | 3 | 3 |

| D | 15 | 3 | 3 | 3 | 3 | 3 |

| E | 10 | 3 | 3 | 3 | 3 | 3 |

| C(Ideal) | 300 | 420 | 420 | 420 | 300 |

1 = Competitor has powerful components

3 = Competitor has equivalent components

5 = Competitor has weaker components

C(Ideal) = Value of the competive position

Here is the resulting goal-portfolio (x-axis competitive position, y-axis own resource strength):

Interpretation

As you see the two portfolios you can extract information and plan further steps:

E.g. accounting has a very good competitive situation (is-portfolio) but its resource strength is too weak and as you maybe consider that accounting is not the most important strategic factor in your company you may slow down your efforts in this topic. Research & development (R & D) has the weakest competitive situation in the is-portfolio, but the biggest resource strength. With the estimated goal-portfolio it seems that R & D is the big winner, i.e. best competitive position and resource strength, so you should strongly consider trying to focus on R & D.

Evaluation of the portfolio analysis

It has a global character, doesn’t explain the is-situation and offers no guidance how to reach the goal-state.

But: supports in setting priorities when planning your strategic roadmap and considers the strategy of your competitors. You are also able to adjust your IT strategy to the competitive strategy (instead of procurement, production, R & D, etc. just use IT systems).

I hope I could give a brief introduction on this topic. I didn’t go into details as it would be too complicated to understand and you would need detailed consulting on this.

So please feel free to ask me regarding this topic or if you have further questions or comments. I am glad to answer your questions and to discuss with you further on this topic.

Leave a comment